The silicon solar PV cell was invented in America, yet we now have no hand in its production. How did we let China dominate solar manufacturing?

An engineer, a chemist and a physicist walk into a lab on April 25, 1954. The next day, The New York Times publishes on its front page that their invention “may mark the beginning of a new era, leading eventually to the realization of one of mankind’s most cherished dreams — the harnessing of the almost limitless energy of the sun for the uses of civilization.”

Daryl Chapin, Calvin Fuller and Gerald Pearson worked at the famed Bell Labs in the 1950s and are credited with creating the silicon PV cell. This American invention ushered in an era of American ingenuity — from satellites and space travel to independent power production on Earth. With so much American technical experience, how is it that 70 years later, the United States has very little influence on the silicon solar cell? How did China come to dominate the solar PV manufacturing market?

U.S. wins the race, but not the marathon

To begin, one must follow the path of the silicon solar cell after it left Bell Labs. First it found a home on American satellites (Russia’s Sputnik 1 used silver-zinc batteries for power in 1957; America’s Vanguard 1 used six silicon solar cells in 1958). The 1960s saw more gains in efficiency, but commercialization was slow to catch on. The 1973 oil crisis pushed the U.S. Congress to pass bills that would force the country to make solar more viable and affordable for the general public. U.S. energy companies — which at that point had mostly dealt with oil and gas — began opening solar research divisions. One of those companies, Atlantic Richfield Company (ARCO), was very successful with its photovoltaics product development.

ARCO Solar achieved many global industry firsts, including being the first panel manufacturer to hit 1 MW of yearly production (1980) and the first to install a megawatt-scale solar project (1982). Through a series of acquisitions, ARCO eventually becomes SolarWorld Americas (a subsidy of German SolarWorld AG), and the technological legacy lived on at its silicon cell and panel manufacturing plant in Hillsboro, Oregon.

SolarWorld is a central theme in the story of the downfall of American solar manufacturing. Whether SolarWorld deserves blame is a matter of personal opinion, especially among those entrenched in the U.S. solar industry in the early 2010s.

SolarWorld Americas became the nation’s punching bag after it filed a trade petition in October 2011 (along with six unnamed solar companies) asking the U.S. government to prevent Chinese solar companies from dumping cheap solar panels into the U.S. market. Many in the U.S. solar industry denounced SolarWorld as anti-affordable solar and against fair competition. They claimed the young U.S. solar industry couldn’t grow without cheaper solar panels. The U.S. government, though, saw SolarWorld’s point that China’s cheap panels were preventing U.S. solar manufacturers from competing in the market, and the U.S. levied antidumping and countervailing duties (AD/CVD) against Chinese solar companies.

China retaliated with its own tariffs on American-made polysilicon and propped up its domestic production. Ten years later, American polysilicon production for the solar market is still deflated and China now holds 80% of the world’s polysilicon supply (nearly half coming from the Xinjiang province). There are no silicon solar cell manufacturers in the United States, and SolarWorld Americas — with its historic influence on the U.S. solar industry — is out of business.

Once a solar manufacturing powerhouse, the United States (and the rest of the globe) now depends on China for its solar supply chain.

The origins of the fight

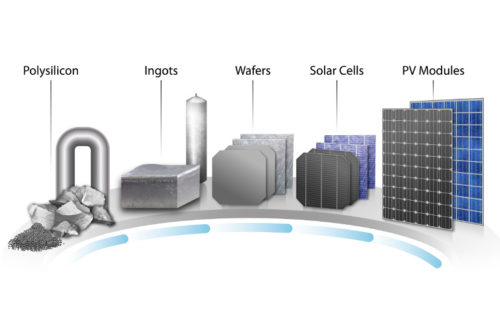

Illustration showing the stages of creating photovoltaic solar panels: polysilicon to ingots to wafers to solar cells to PV modules. (Illustration by Al Hicks/NREL)

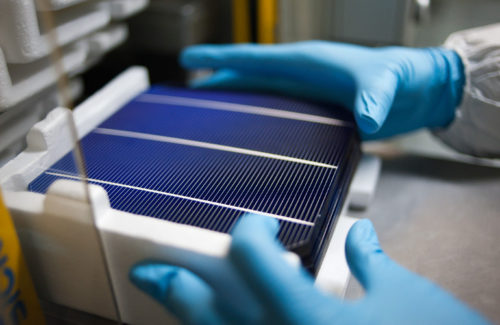

In 2011 when SolarWorld Americas made its official complaint to the Dept. of Commerce citing unfair trade practices by China, the U.S. manufacturer participated in every step of solar panel manufacturing — it melted and shaped polysilicon into ingots, sliced the ingots into wafers, doped the wafers into cells and finally assembled the cells into finished solar panels. The company had just started a significant investment into advanced mono-PERC solar manufacturing when SolarWorld’s locked-in polysilicon supply contracts were priced considerably higher than what China was offering, said Desari Strader, then-head of government affairs for SolarWorld Americas.

“They were beating us on the cost of production,” Strader said of Chinese suppliers at the time. “We had just finished ramping up [to mono-PERC]. Of course the Chinese could come and dump [cheap panels] in the U.S. It was super easy. Then everyone is screaming that you can’t compete with [Chinese module prices.] Yeah, you’re right. We can’t compete with slave labor.”

The Xinjiang province of China has long been associated with alleged human rights abuses. The United States and many other international democracies believe that China is forcing those of the mostly Muslim Uyghur population into labor camps in the Northwest portion of the country. The situation is being described as an ethnic and religious genocide of the Uyghur people. Xinjiang became a polysilicon manufacturing hotspot in the late 2000s, after China established an economic plan that prioritized solar and polysilicon development, and subsidized local manufacturing. Soon enough, Chinese companies were churning out cheap solar panels, boosted by state-funding — and possibly forced labor.

“If 30% of the cost of a panel is your polysilicon, and you’re not paying wages, [of course] they were beating us on the cost of production,” Strader said.

Strader said that once there was no way to avoid American-made SolarWorld modules (with high-priced polysilicon contracts) being more expensive than Chinese imports, SolarWorld moved forward with the court case to protect not only its investment in cutting-edge PERC technology, but also American solar manufacturing.

An opposition group called the Coalition for Affordable Solar Energy (CASE) quickly formed, fronted by SunEdison founder Jigar Shah (who today works at the Dept. of Energy). CASE membership said that any duties on imported solar modules would increase system prices and hurt the growing solar installation workforce — which was significantly larger than the U.S. solar manufacturing pool.

“SolarWorld is looking to single-handedly kill U.S. solar jobs, which are primarily in solar installation, not in solar cell or panel manufacturing,” Shah said in a statement back then. “The government shouldn’t reward or protect one German company that is not fitting into the thriving global solar industry. It also should not punish the American companies that have found a job-creating niche in that same industry. The prosecution of this trade case is not going to solve the problem of promoting American manufacturing — it will just disrupt the industry.”

SolarWorld responded to the backlash (in Solar Power World in Dec. 2011): “While subsidies are not inherently improper, it is illegal for a nation to use them to ramp up domestic production to grow well beyond the needs of domestic consumption and then dump exports at prices below production costs into a foreign economy with the effect of destroying that foreign economy’s market and industry.

“Such is precisely what China is doing.”

In 2012, the Dept. of Commerce imposed AD/CV duties on U.S. solar cell imports from Chinese manufacturers ranging from 23 to 35%. For any Chinese company that didn’t agree to have its bill of materials investigated by the United States, the duty was a hefty 250%.

Thus started the trend of Chinese module manufacturers shipping solar wafers to Taiwan to be made into solar cells and then back to China for module assembly to avoid the tariffs. U.S. solar module prices were not drastically affected by the anti-dumping taxes.

What was affected was the American polysilicon industry.

Polysilicon gets a raw deal

“SolarWorld filed those trade cases for modules and cells. Then China retaliated and put it against us [polysilicon producers],” said Chuck Sutton, VP of FBR polysilicon sales and an employee at REC Silicon for 30 years. The three U.S. polysilicon producers still affected by this saga are Hemlock Semiconductor Operations, REC Silicon and Wacker Chemie AG.

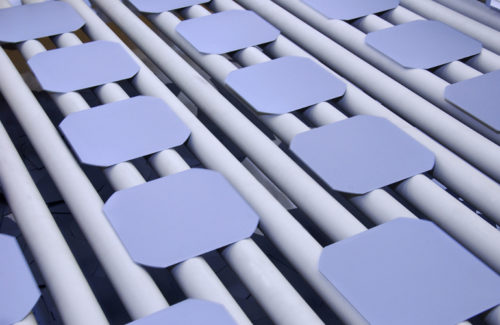

Archive photo of polysilicon ready to be formed into ingots at SolarWorld’s Oregon manufacturing facility.

In direct retaliation to the U.S. tariffs on imported Chinese solar cells, China in 2013 placed its own high duties on American-made polysilicon. At the time, it was reported that the United States produced 24% of the global polysilicon market. The large majority of REC’s U.S. polysilicon production was supplied directly to China — its Moses Lake, Washington, facility (which catered to solar) exported 80% of its polysilicon to China, while its Butte, Montana, plant (which largely supplied the electronics market) exported 50% of its product to China.

Also at the time, Hemlock had a facility in Michigan and was working on a new plant in Tennessee. Wacker was also in the middle of building its own $2.5 billion polysilicon manufacturing plant in Tennessee. Hemlock closed its Tennessee venture in 2014 while Wacker continued with its investment although the polysilicon market bottomed out. Along with REC Silicon, the three once-competitors released a joint statement in 2019 claiming that the effective ban from the Chinese market resulted in the U.S. polysilicon market shrinking from $1 billion in 2011 to $107 million in 2018.

Although initially shut out of the Chinese market, American polysilicon suppliers could still work with other countries and found decent supply need with Korean and Taiwanese solar wafer and cell companies, until China restricted imports from those countries, too. Not only was China ramping its own production of polysilicon, it was also overtaking the global solar wafer and cell supply chain.

Outside of China, solar wafer and cell manufacturers are limited. There’s NorSun in Norway (currently less than 500 MW), LONGi in Malaysia (~1 GW), JA Solar in Vietnam (~1 GW), Meyer Burger starting up in Germany (~1 GW), and possibly a few smaller outfits in Taiwan — maybe 4 GW in total. Meanwhile, the three U.S. companies have much larger production capacities (probably around 23 GW at full capacity). And this isn’t considering any polysilicon production in Europe.

“Our issue right now is there is no ingot wafer capacity, or at least not enough, outside China,” Sutton said. “You’re looking at 20 to 40 GW of polysilicon trying to fight for 4 GW [of wafer production].”

This oversupply situation forced REC to shut down its Moses Lake plant in 2019. Its Montana plant is still making polysilicon, but only for the electronics market. If China doesn’t allow American imports, and if a non-Chinese solar supply chain doesn’t get set up soon, Sutton said REC will invest more in next-generation lithium-ion battery technologies that use silicon. The company currently is testing this new venture on a pilot line in Moses Lake.

But in order for silicon-doped lithium batteries to turn into significant contracts for REC, “we need the electric vehicle market to take off, but likewise, China is dominating that market,” Sutton said.

Can America get its solar groove back?

In June 2021, the United States escalated the now 10-year battle with China over polysilicon and solar. U.S. Customs and Border Protection (CBP) issued a Withhold Release Order (WRO) on silicon-based products made by Hoshine Silicon Industry Co. located in Xinjiang, in a stand against products using forced labor entering the global supply chain.

Hoshine produces industrial silicon, which can find its way into polysilicon products. Although the United States isn’t a huge importer of Hoshine silicon (only $6 million in direct imports last year), Hoshine does supply silicon to several Chinese firms whose polysilicon undoubtedly ends up in solar cells and panels entering the United States. CBP officials confirmed its ban includes finished solar panels containing Hoshine materials.

While this WRO isn’t wholly a reaction to the solar industry (silicon is in a lot of semiconductors and electronics that the federal government uses every day), its long-term effects could start a shift to non-Chinese solar supply chains. Desari Strader, the former head of government affairs for SolarWorld Americas, thinks so. She is the founder of U.S. solar manufacturing startup Violet Power. Many on the Violet Power leadership team have deep ties to the U.S. solar industry and SolarWorld — including CEO Charlie Gay, who previously was CEO of ARCO Solar and helped SolarWorld transition to mono-PERC technology.

Violet Power made a big splash in 2020 when it announced it would have 500 MW of solar cell and 500 MW of solar panel manufacturing in Washington State by 2021, with an eventual scale to 5 GW of annual production. It was a bit of a premature announcement, with the company underestimating how difficult it would be to establish a non-Chinese supply chain.

But now Violet Power has regrouped and plans to be the first falling domino that forces a more domestic supply chain. If Violet Power can absolutely commit to a large amount of solar cell production, then other U.S. startups will have the guarantee of a major customer and can begin making wafers and ingots here at home.

“The mission is this: We owned this technology; we built this technology. It was birthed out of Bell Labs. It powered the first satellite dishes. We’re bringing our technology not only home, but to scale with a U.S. supply chain,” Strader said.

All Violet Power needs is other players to step up.

“We were never going to limp into this with 1 GW [of cell production]. You have to go 3 to 5 GW out of the gate to get all the other upstream/downstream players ramping back up with you,” Strader continued. “The timeline is nine to 12 months for a module line [to get started], six to nine months for wafer, ingot is 18 to 24 months. The only way they can do that is knowing they have at least one cell company to feed into. That’s what Violet Power is going to be.”

Wafers coming off the line at SolarWorld’s Oregon manufacturing facility. Archive photo from the Oregon Department of Transportation

A federal manufacturing tax credit would also help tremendously. The Solar Energy Manufacturing for America Act introduced in the Senate this year would provide tax credits for American manufacturers at every stage of the solar panel manufacturing supply chain, from production of polysilicon to solar cells to fully assembled solar modules.

The suggested credits to manufacturers include: 7-¢/W for solar panels, 11-¢/W for integrated modules, 4-¢/W for PV cells, $12/m2 for silicon wafers and $3/kg for solar-grade polysilicon.

“The manufacturing tax credit has to go through if the U.S. is going to do anything on climate change,” Strader said.

The proposed tax credit has already led one company to announce U.S. module manufacturing plans. Convalt Energy purchased the equipment at the former SolarWorld plant in Oregon and is moving it to New York to set up a 700-MW module assembly plant that will open in 2022. But without wafer and cell production in the United States it still has a Chinese solar supply problem.

“There’s a missing gap. The ingot wafer is a missing gap,” REC Silicon’s Sutton said. “You have people on one end that say we need to let more cells into the U.S. to do this 20 GW [of solar installations] we need. Then you have those people that want to put in cell lines but they want wafers, which can only come from China right now. So, you have this gap.

Stacked wafers at SolarWorld’s Oregon manufacturing facility. Archive photo from the Oregon Department of Transportation

“They want to have these U.S. facilities, but your choice for supply is very limited. For these people to be successful, they either need to accept that’s the way it’s going to be, or we need to get together and invest in ingot and wafer production,” Sutton concluded.

In August 2021, California solar panel assembler Auxin Solar and former solar cell producer Suniva filed a petition with the U.S. International Trade Commission to extend safeguard tariffs on imported solar cells and panels through 2026. Within the court documents, Auxin stated that with continued tariffs (which initially began in 2018 from a completely different case not discussed here), it could bring wafer production stateside. Suniva claims that only with extended tariffs can it restart its dormant solar cell production facility in Georgia. Clearly there are ambitious companies out there, but the future of the U.S. solar manufacturing industry will likely depend on government support — through subsidies, tax credits and competitive tariffs.

Back in 2011, Gordon Brinser, then-president of SolarWorld Americas, pondered in an op-ed: “The U.S. solar market and solar installations will continue to grow with or without China’s unfairly traded goods. Solar is here to stay. The only question is whether U.S. solar manufacturing will still have a role.”

Ten years later, the United States is still trying to sort that out.

Nice article! I will need to re-read it and the comments. Not an expert.

That being said, I have a vague recollection that, in the mid-2010’s, the two companies requesting tariffs to protect US solar manufacturing had management dominated by Chinese and German teams. Please correct me if I am wrong, but it seems a reasonable question whether or not US-based manufacturers are vulnerable to being bought out by foreign interests. Similar to concerns rising in agribusiness.

HI,

Our company specializes in re-export operation of solar photovoltaic re-export trade to avoid the high anti-dumping duties of the United States/India/Turkey, and there are no problems in a large number of operations! –The United States investigates four Southeast Asian countries (Vietnam/Malaysia/Cambodia/Thailand), and it is expected that the preliminary ruling will be made within 5 months!

Re-export process: The goods are first shipped from the Chinese port to the port of the re-exporting country (such as the port of Colombo, Sri Lanka)–customs clearance into the local bonded warehouse in Sri Lanka–changing cabinets–photographing–re-declaration for export–apply for Sri Lanka after the second-way ocean bill of lading is issued To the United States CO certificate of origin / to India to Malaysia FORM AI certificate of origin, to Turkey to Malaysia MTFTA (such as the attached sample), all documents are Malaysia / Sri Lanka for customs clearance at the port of destination, the United States / India generally 0 tariffs,

In addition, our company has branches in Malaysia and the United States, which are used to deal with local re-export customs clearance and delivery matters. The efficiency is faster, and there is a need for more exchanges.

贵司外贸业务,大家好!

我司专业转口操作太阳能光伏转口贸易规避美国/印度/土耳其反倾销税高额关税,陆续大量操作中,均无问题!–美国调查东南亚四国(越南/马来西亚/柬埔寨/泰国),预计5个月内会初裁!

转口流程:货物先从中国港口海运到转口国港口(如斯里兰卡科伦坡港)–清关进斯里兰卡当地保税仓库–换柜-拍照–重新报关出口–出了二程海运提单以后去申请斯里兰卡到美国CO产地证/到印度出马来西亚FORM AI产地证,到土耳其出马来西亚MTFTA(如附件样本),所有单据都是马来西亚/斯里兰卡用于目的港清关,美国/印度一般 0关税,

此外我司在马来西亚,美国均有分公司,用于处理当地转口清关派送事宜,效率更加快捷,有需要多交流!

感谢!

Thanks&Best Rgds

Mr ALLEN

XIN RUI DA LOGISTICS CO.,LTD

If Desari Strader is the hope of the US Solar industry then it is screwed.

Looking at all of the lawsuits filed by unpaid employees, it seems that she also believes in slave labor.

Charle Gay has not been involved with Violet Power for several months.

https://www.bernreuter.com/newsroom/polysilicon-news/article/break-up-with-rec-points-to-deeper-problems-at-violet-power/

There is no evidence that her labors were forced. Instead, they were fooled.

Did someone in the solar industry just wake up?

Maybe not yet. Maybe not at all.

There is effective solution to handle the problem of supply chain disruption. US shouldn’t only support own manufacturing but as well look into supporting allied countries to substitute Chinese supply. We have manufacturing of PV Modules in Georgia (Europe) using non Chinese components for US market. Our holding company is US based and main investor as well is US based venture capital fund. Now we are looking for additional investments to establish cells manufacturing. US is the main investor and technology provider of China since President Nixon made his great Chinese deal. China couldn’t become the great economic power without US support. In the same way US can put into competition to China allied democratic, free countries like Georgia, investing, owning manufacturing there to use local affordable labor with headquarters in US. Then combination of US made polysilicon with further processing and assembly abroad, but headquartered together with R&D and all patents in USA will be economically feasible and internationally competitive. US will have long term benefits supporting with technology and investments allied countries who see their future with the same values as US does.

P. S.: I saw in previous comments denial of forced labor issues based on automated manufacturing approach, but cells manufacturing cannot be fully automated yet. For 500 MW cells manufacturing you need at least 500 people staff. It’s ironic but communists decorating themselves mainly as workers party in fact are the biggest forced labor exploitators worldwide since they started to exist and it cannot be changed as basically there is no freedom. I know it as I was born in USSR and I’m happy it doesn’t exist anymore.

FYI, 15,000MW of cell capacity takes only 3,000 highly-motivated and well-trained staff in China. That is 100 staff per 500MW. That is one fifth of what it takes in the labor-intensive Georgia(EU).

Well said. I would like to ask where all the writers and commenters on this thread were when we stood with SolarWorld and US Solar MFG and testified at the ITC and got trolled constantly for our stance. We were bad for the industry and driving up costs because we sounded the alarm on the unfair trade games China was playing.

Why did we make that stand? Because we knew this would happen and here it is.

There is a very simple fix. Make ITC permanent or extend it and REQUIRE that ALL major solar components be MFG in the USA to quality for the ITC, then drop all the tariffs. You will see a surge in US solar MFG like never before and we will no longer need Chinese imports.

Excellent reporting and article – thank you!

Kelly, thank you for your article. As a solar panel manufacturing startup the supply chain is critical and in some ways debilitating. It would be great to be able to source all materials from the US. Glass is difficult, EVA and backsheet are possible, cells, as you point out nearly impossible.

Crossroads Solar is focusing on starting small 6-10MW production as we work the supply chain mechanisms made even more difficult by Covid. Domestic production of the inputs for panel manufacturing would effectively ease the supply chain constraints that we all confront.

I would love to see the day when I could source wafers from a US facility but it takes everybody to accept that there will be an added cost to solar produced in the US. The consumer demands price point sensitive installers so installers demand prices that are competitive with imported panels, even if the Nameplate leaves the impression that they are produced in the US.

Dear solar friends, I have observed in india, Dubai, UAE, middle East countries and USA as well, that when we see the issues raised after covid19 situation all over the world. And many countries started reaction and said not to use Chinese products including USA, Germany, Italy, England, European countries India, Australia etc.

But in reality still projects are won by Chinese brands and companies for all these countries, and it’s just due to dominate the market product availability difference.

Where as in terms of technology even other countries and brands are capable of doing projects and business. I think it’s matter of trust we should have.

I am not against of any specific brand or country region. But dominate the market will be bad impact on economy of the every country and further in our business end leads to jobs losses etc. On fare side tender should have region specific so that everyone will have change to do business and support the projects in future. (Example : if company is putting the project in other country, then the local business community can be helping hand with JV opportunities to work for, these will also get the benefits both parties and working will be smoothly for any projects)

Hi Kelly…an excellent article…here in New Zealand we were purchasing Arco BP and Solarex solar hardware many years ago. Let’s take the word communism out of the discussion and simply say that when China is confronted with a problem..they look for a solution and if they cant find one..they produce one. One classic example was when the US decided to stop exporting silicon ingots to China because it was believed back then that without the ingots there would be no cheap solar panels for the US market. It didnt work because China managed to design and build their own furnaces in about 6 mths…I was there at the time. Their drive to overcome engineering obstacles knows no bounds. The other aspect of Chinese Solar panel manufacturing that even today gets fake media attention is their apparent use of slave labour. I’m sorry but sadly it’s not true. I have visited numerous factories and believe me..even in the early production days when they had someone sealing the frames with a silicon squeeze gun…there were no slaves in the factories and there certainly is none in their newest production plants…its hard to see a single staff member..the factory floor is full of the best German and Chinese robotics that can be produced…yes it’s true that China has shifted some production outside of China eg Longi into Malaysia etc. but no slaves are involved there either..

The demise of the US solar industry from its early and promising beginnings was due to a number of factors both political and industrial combined with the raw capitalist intent of the big conglomerates at the time who missed the opportunity to move fast..and realize the massive solar business that lay just around the corner. One millstone that America has is the cost of moving exported goods globally..someone should take a fresh approach to this problem.. My father imported cars and engines from the USA and Canada in the pre container era..but now shipping costs from the US are simply prohibitive…even for small goods.

You are a man from the real world.

Finally Bill you stand out to debunk this myth of slavery. US is so fond of blaming others instead of solving the real problem. The fact is simple and painful, American industrialization failed in the fair competition with China just in the same way it had failed with Japan and Korea. The answer is always simple: Educate more engineers, provide better affordable healthcare and make sure workers share the profit they make. Japan, Korea and now China all won US in the same way and US hasn’t learnt yet and it appears people will never learn.

Great and truthful input! I too agree that we need to stop looking outwardly at our mistakes in the US and focus internally on why we can’t step up to the plate to be more competitive. I also agree that we put way too little money and importance into training and employing a solid technical workforce. Everywhere you look, bloated executive ranks are pulling in all the money while trying to minimize and underpay their technical workforces. We have a tendency to punish out of the box thinking (although that appears to be changing more and more these days) and push for quick solutions over taking the time to really work through problems and come up with meaningful solutions that consider all possible ways to recover from external influences.

Lastly, thanks for providing alternative insight into the labor situation. I, too, have been a believer of the negative things said about Chinese labor practices. So it was helpful to get that clarity.

All countries should have the ways and means to make their own systems.

Thanks for sharing your insights about silicon solar, it’s history and how basically slave labor destroyed American solar!

Not anymore, because we finally have Tesla style industrialism at the heart of the American rebound.

It’s only fair that we subsidize US mining and the industrialization of the solar supply chain – along with LFP storage (and not quite long range) EV batteries, to an even greater tune than China. It’s time to call it what it is, American innovation and reinvestment.

Some, here, have suggested that it’s communist to subsidize American solar. I need to inform them that it’s the communists that don’t want the American tax dollars to outdo China at their own game!

We also need to basically outlaw any regulatory restraints that seek to set us back.

China doesn’t allow for that, why should we? It’s not like our industrial clean energy and battery companies will dump arsenic on the ground.

Unnecessary EIS can set us back many years.

As the world gets hotter, our economy isn’t the only thing at stake!

Dear Kelly,

I’ve witnessed the collapse of U.S. PV industry after 2007 in this field.

Key factor is every body needs quick money. No investment was done after pilot plant scale test of polysilicon plant. After 1980, no more technical improvement was done. Some improvement was done by some scientist but commercial scale output was prevented because of money.

China starts from the pilot plant scale technology, which is open to public after 20 years. It’s free to use that technology. But, they also didn’t add any new technology to that. Instead, they choose to save money. Slavery man power, coal for heat source, no electricity fees, etc.

Without solving this problems there is no way to win this game. During this period some U.S. companies developed some technology. But, they were collapsed by attack from China. China didn’t pay them.

Investment only to down stream of polysilicon is to ‘pee on the back of frozen foot.’

Make China play fair game.

Bravo, excellent coverage

Great article Kelly,

Please write a follow up how China is buying up Solar and other companies out of Bankruptcy caused by Covid-19 “that will make you think hum”. They have purchased the largest residential solar/roofing company Petersen-Dean, Solar4America, Roofs4America and EV manufacturer Phoenix automotive, I’m sure others.

Slave labor is alive and well in Communist China.

Insofar as Chinese robots don’t get paid anything, sure, OK, whatever. But I cringe every time I hear these whiney bleatings that Chinese PV manufacturers are all cannibalistic carbon-belching slave-traders as the only plausible explanation why American PV manufacturing is pathetic.

At some point, we’re going to have to stop leaning on: “China makes PV panels out of babies kidnapped by the Clinton Foundation ‘ya know,” and start dealing with reality. And that reality is that we’ve been out-competed by motivated, extraordinarily competent Chinese manufacturing engineers and financiers who’ve used a 10-year window of generous home subsidies and support to more or less singlehandedly disrupt the global energy economy by breaking the grid-parity barrier for photovoltaics. So, we can either waste our time signalling our virtues with under-baked allegations, or we can get busy doing the hard work our competitors have already done in building up a full supply chain and continuously improving it for the next decade. Mouthing off is going to feel good in the moment, but it’s only hard work that will actually get us somewhere useful.

This

So well told. Excellent reporting.

This is nothing new. We can’t blame any other country but ourselves. Just look at the laser disc, video tapes, cd’s, etc. They were all products made in the US but we allowed Japan to mass produce them, exported them back to the US and made a fortune as we were too stupid to take advantage our our inventions.

It’s a sad state of affairs, that Bell Labs launched this technology and an industry was formed. Here is what was missing back in 2008 to 2011, TOPCon type N and type P technologies, tighter line widths in the IC industry and the ability to make 7nm transistors and basically the ability to use chemical gasses and “dope” a solar PV cell to ever tighter conducting array cells within a simple silicon wafer. But perhaps the biggest fail of all is none of these manufacturers had the presents of mind or ‘vision’ of powering their manufacturing line(s) off of the very solar PV panels they are ultimately making.

For right now the (only) solar PV manufacturer that is planning on making their product on solar PV powered manufacturing lines by 2028 is the thin film utility panel manufacturer, First Solar. It was pointed out by SEIA and others in the solar PV industry, that tariffs would not work with China. When all was said and done, China could ship raw or supply chain goods around the World to abrogate WTO actions and country tariffs. The fast (fact) became clear, of about a total of 10,000 people laid off when solar PV manufacturing plants in the U.S. failed, there was a loss of around 250,000 installation jobs across the U.S. due to these tariffs, then the Covid-19 isolation period.

“In June 2021, the United States escalated the now 10-year battle with China over polysilicon and solar. U.S. Customs and Border Protection (CBP) issued a Withhold Release Order (WRO) on silicon-based products made by Hoshine Silicon Industry Co. located in Xinjiang, in a stand against products using forced labor entering the global supply chain.”

Cutting out high energy costs, finding new ‘focused’, perhaps scanning high energy laser automated manufacturing. Getting manufacturing down to the science of speed accuracy and yield using solar PV and or wind generation to power the plants is the “way” around another didactic of wars for oil, OPEC, blood diamonds, I’d rather have the so called AM III glass ‘like’ substances made from buckey balls, heat and extreme pressure. Now there’s forced labor, civil unrest Cobalt, slave labor silicon. Our fight is NOT in some Voodoo World wide political pot, it is within our own borders using superior skills and knowledge to make a better product faster, cheaper and reliably.

” But now Violet Power has regrouped and plans to be the first falling domino that forces a more domestic supply chain. If Violet Power can absolutely commit to a large amount of solar cell production, then other U.S. startups will have the guarantee of a major customer and can begin making wafers and ingots here at home.”

I’d like to see this happen, from some research on the type of cell connection and back contact being proposed, some lab based cells have shown in the neighborhood of 25% to 26.1% light harvest efficiency, what would mass manufacturing look like? Violet is also promising less LID over the life of the product and a (warranty period) of 50 years.

Before they moved the line to Malaysia and Philippines,SunPower/Maxeon tried to make the IBC cells Violet Power dreams today in America .

You know what? Only forced labors are capable of making things happen affordably.

Excellent, objective summary Kelly.

Missing from this saga is the effect the Chinese dumping had on next generation thin-film solar cells, and how some US manufacturers took the (state and federal grant and loan) money and ran (to China) after paying their executives ridiculously large bonuses.

As a scientist and engineer, I was fortunate to be able to fall back on training and experience in installation to remain in the industry. Many colleagues were not so lucky.

Thanks for the article.

Yes. It is unfortunate this thing between the US and China but we won’t give up. There’s more than one way to get energy. We’ve proven we can build a vehicle engine that starts with a hand crank. The first vehicles we had started by hand cranks. Now we’re even more educated and have even more ways to keep that engine running without the use of fuel. Wood. Fire. Water….Steam. we know about steam and how to multiple its pressure. Even enough pressure to push and pull pistons to run an engine. I have ideas but at the rate my state is sinking. With no help coming from the President, my whole Cajun state needs to move north. But that’s not how we roll. We stay. We stand. We conquer and build stronger. And we can do it , if we stand together. Use our brains a little, as a community, gear up and prepare We can do this……. If… . . We come together and learn from one another. We damned sure don’t need the White House to put their two cents in. China is no better off than we are. There’s no reason to believe China is on top of the world. And hopefully the White House gets this message from Louisiana that we don’t need ya and let the rest of the world see that that America will live on without ya. Proudly and rightfully so. It’s just who we are.

Oh ….that was a great article. You really kept me engaged, as you can tell. Lol ..But I totally agree with you. We are not lacking in knowledge of how to live in nature with just a stick. Well be fine without China. Loved the article. Thanks.

I see absolutely no mention of First Solar inc that has expanded in Toledo now employing clse to 3000

First Solar does not use polysilicon in its solar panels.

I see your point completely and yet also see, this is a way to beat China, by having a technology online, thin film , proven by 22 years of use, that can be powered by the sun to manufacture more solar PV product with solar PV electricity. All of these “cost analysis” of end to end energy costs for product output makes for a better overall product despite the Chinese race for efficiency pushing 24 to 25% on the latest/greatest solar PV panels being manufactured. People like to ‘bag on’ Solyndra as the quintessential solar PV failure and “boondoggle”. Solyndra was at the ‘time’ the most efficient solar PV product on the market (for a very short time). When one wanted solar PV, they could buy four to six more Chinese solar PV panels, put out the same generation per day and cost almost half what Solyndra was manufacturing.

OPEC has rubbed the U.S.s nose in the dirt during the 1973 oil embargo and (again) in the 1977 oil embargo part two. China has flooded the World with cheap solar PV modules for at least 15 years and will continue to do so. The mass manufacturing is already established World wide, we here in the U.S. would hurt ourselves before it would hurt China, we already have.

The importance of your information in this article, resonates that silicon foundries are needed for the IC chip production and solar PV supply chain for this country and I do believe it is a matter of national security on so many levels. The politicos throwing the “cheeseball”, guilt trip of “slave labor” on a country that has a population of around 1.5 billion that (really will) “work for food”, is childish with expectations that supply chains will just magically “pop up” and force the slave labor out of Chinese society.

CdTe is nice, but its dependence on tellurium is a problem (not very much of the stuff in the world). Won’t be a solution that scales to the size of America’s needs, I’m afraid.

I would expect the “shortage” of Te is as “real” as a shortage of lithium. Seek and ye shall find. As for First Solar’s chops at making thin film solar PV panels for 22 years, it is also possible this company could “solve” the Perovskite problems and create multilayered spray on or print on technologies that would produce the cheap 30% plus solar harvest efficiency, without needing the extra energy of foundry’s. As, Sb, Ge are in the same class as Te, one could pull enough As out of domestic water supplies to use as a feedstock for future solar PV panel chemistries. First Solar has had an established cradle to cradle recycling program in place since 2003, grind, separate elements, reuse on the manufacturing line.

“When one wanted solar PV, they could buy four to six more Chinese solar PV panels, put out the same generation per day and cost almost half what Solyndra was manufacturing.”

Any links you may assist with in finding energy efficiency per SF of PV for architectural rooftop use? To maximize DC power use in future facilities, I cannot afford to waste collector space. TIA.

When you start talking about “architectural roof top” now you’re getting into the solar PV tile arena and it appears there are still some out there and they are all expensive. TESLA is usually the first name mentioned when talking about solar PV tile roofs, just recently TESLA “adjusted” the cost of their installed solar tiled roofs. When one gets to this point it is a roof tear off to the boards and reinstallation with the solar PV tile and matching roof tiles to fill in unused and shaded areas of a roof. TESLA “seems” to be going from $50K to $100K per roof installation.

Luma is another solar PV tile company and another that’s been around for a while is CertainTeed solar PV tile company. Like any construction project I’d get three quotes and see how they plan on “solarizing” your roof and get some real customers as references and see how their overall experience with these companies have been. The unfortunate thing about these custom solar PV tile installations, you can’t use standards like a 400-450 square foot racked panel solar PV array on a roof could supply 6.6kWp to 8.1kWp. There seems to be many foreign companies delving into the solar roof tile like Meyer Burger is supposed to start a line of solar PV tiles this year and next year.

Yes let’s do what we should do let’s create our own company and let’s do something new let’s think outside the box and let’s do it here in the United States let’s create a a product that is better than solar panels easier to make come on all you people with great minds get your heads together let’s do this as America we need answers we need some really good products that are made here in this country

Fantastic piece!

The complete story and now we all know that it’s time for the US to invest in ingot + wafer production

“the future of the U.S. solar manufacturing industry will likely depend on government support”

We don’t want communism in USA!

Are US defense contractors communist? What about American farmers? US tech firms? All are receiving massive subsidies, grants, and tax breaks in order to compete and prosper on the global stage.

It’s in the US’ best interest to make sure that we, and our allies, are the best in class in all fields, and unfortunately, we’ve fallen drastically behind as China is willing to ensure their own businesses and industries succeed and prosper through governmental support (and likely, literal, slave labor) while the US continues it’s outdated “pull yourself up by your own bootstraps” policies that have never actually made Fortune 50 companies.

Surely the world does not want communism in the USA, but at this point, if the American industries are protected, foreign communism is already controlling the USA

THANK YOU!!

FINALLY somebody tells the whole story.