The second-largest crystalline silicon solar panel manufacturer in the United States has stated in documents to the Dept. of Commerce that it is planning to establish a solar cell manufacturing outfit in the Southeast. But industry vulnerability related to Commerce’s investigation into AD/CVD circumvention by Southeast Asian solar companies has halted progress on the facility.

Silfab, a Canadian solar panel assembler with 800 MW of manufacturing capacity in Washington, has identified the site for its new cell manufacturing facility, negotiated leases for the site and equipment, and finalized state and local incentives to construct the facility, the company has stated in multiple documents to Commerce related to the AD/CVD circumvention investigation.

The investigation holding up Silfab’s plans was requested by California-based solar module assembler Auxin Solar. Auxin claims that Chinese crystalline silicon solar panel makers have moved portions of their manufacturing operations to Southeast Asia to circumvent antidumping and countervailing duties that have been in place since 2012. Commerce is looking into solar panel operations in Cambodia, Malaysia, Thailand and Vietnam to see if Chinese wafers, aluminum frames, backsheets and more have been used in exported cells and modules. If enough Chinese product is found in Southeast Asian module exports, DOC could extend the AD/CVD to the mentioned countries.

Since the investigation started in March, module supply from Southeast Asia — a region that supplied 80% of U.S. demand in previous years — has been limited or completely halted. A survey to SEIA members found that 75% had solar panel deliveries canceled or delayed within a few days of the DOC starting its investigation at the end of March. Almost all those surveyed were predicting this investigation to have a severe or devastating impact on their businesses.

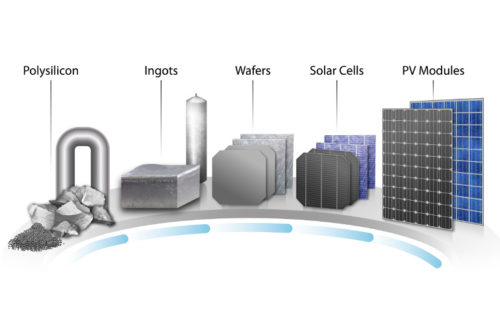

The solar panel manufacturing process, from polysilicon to ingots to wafers to solar cells to PV modules. (Illustration by Al Hicks/NREL)

Domestic panel manufacturers are also feeling the effects of the investigation. With no solar cell manufacturers in the United States, all supply of the core component of solar panels must be imported, and supply has been limited. A company like Silfab trying to establish solar cell manufacturing in the United States still needs access to silicon wafers, which are also included in the circumvention investigation.

Commerce’s current guidelines for circumvention inquiries pertains to merchandise using affected components that are completed or assembled in both foreign countries and within the United States, which would make production of solar cells in the United States highly vulnerable to further rulings, Silfab said.

Silfab has stated that this “vulnerability will delay and possibly derail permanently” its efforts to build U.S. cell manufacturing capacity.

“After making significant strides towards establishing cell capabilities in the U.S. … Silfab USA has halted progress on this project. Silfab USA will not restart this significant project while a threat looms that Commerce could likewise prosecute anti-circumvention actions against solar cells and modules manufactured at Silfab’s U.S. facilities. Unable to take this risk, Silfab will not restart its work to construct a cell manufacturing facility until Commerce clarifies the situation and issues its final determination,” the company stated.

Commerce is expected to issue a final determination on this matter in January 2023 after suggesting a preliminary decision in August 2022.

Silfab concluded its most recent letter to DOC:

“The negative impact on U.S. solar supply chains from Auxin’s unilateral request is significant and far-reaching, particularly given the reliance (as Auxin has acknowledged) of U.S. module producers on CSPV cells comprising Chinese wafers for their manufacturing operations. The bottom line is this: Commerce’s continuation of the circumvention inquiries at issue here is a threat to the entire solar industry. Commerce and Auxin have already disrupted the solar supply chain, including U.S. cell and module manufacturing, at a critical time for U.S. energy needs and the Biden Administration’s efforts to reduce greenhouse gas emissions and confront climate change.”

Solar Power World reached out to Silfab for further information, but our requests for comment went unreturned.

Silfab has started to assemble its equipment in preparation of starting the manufacturing of panels here in Fort Mill South Carolina.

What is the most current update on this situation of importing the polysilicon?

” A company like Silfab trying to establish solar cell manufacturing in the United States still needs access to silicon wafers, which are also included in the circumvention investigation.”

There is the “bottom line” in solar PV manufacturing, four of the five steps to make solar PV panels is pretty much owned by China right now. There are Chinese solar PV companies with solar PV panel lines in the U.S. manufacturing product right now. The solar PV cells are for the most part from China and already under the 201 tariffs already applied. So, what’s the deal, Auxin wants to “double tax” solar PV panels from Malaysa when the Chinese supply chain of silicon materials is already under the 201 tariffs? What really needs to be done is to jerk Auxin out of their cocoon like chairs, slapped around and slammed back down to the reality, to beat China you have to tune a manufacturing line to do it better, faster, cheaper with higher yields than China manages, you take on the supply chain yourself and develop and construct your own here in the U.S. or concede you don’t have a clue, file BK and step out of the arena.

There’s this part of the narrative not talked about much. Before Covid-19 China was enhancing the manufacturing lines of bifacial solar PV panels and should be ready by now to flood the market with bifacial offerings which seem to have been given a pass on the 201 tariffs. The policy so far with the U.S. is a repurposed use of the adage: “Cutting one’s nose off to spite their faces.” Welcome to dunce town and the popular dunce Logic.

Thanks for your great reporting. The petition seems so broad that it could wrap up potentially anyone that relies on China-sourced components. Do you have a sense of why the US Jinko and Hanwha Q CELLS plants are still (I presume) producing modules with polysilicon/wafers/cells likely sourced from China, yet Silfab is pumping the brakes on their own manufacturing?

Is it different risk tolerance? Are domestic manufacturers not at tariff risk? Is my understanding of the investigation fundamentally flawed?