The Dept. of the Treasury and Internal Revenue Service have released guidance for solar project developers seeking a bonus credit for using “domestic content” via the Inflation Reduction Act (IRA). The Dept. of Energy and Dept. of Transportation assisted in the guidance.

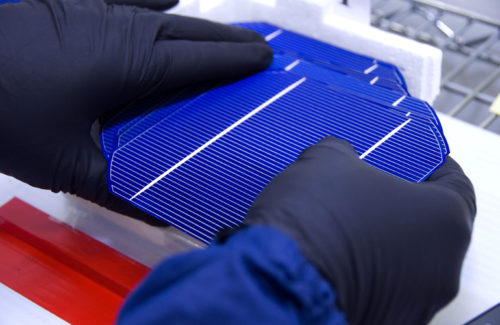

Solar cells at SolarWorld’s Oregon manufacturing facility. Archive photo from the Oregon Department of Transportation

Projects that use American-made racking, ground screws, trackers, solar panels, inverters and energy storage systems can receive the bonus credit, under certain requirements.

“The domestic content bonus under the Inflation Reduction Act will boost American manufacturing, including in iron and steel, so America’s workers and companies continue to benefit from President Biden’s Investing in America agenda. These tax credits are key to driving investment and ensuring all Americans share in the growth of the clean energy economy,” said Secretary of the Treasury Janet L. Yellen.

Projects that meet the domestic content requirement can receive a 10% bonus under the production tax credit (PTC) and up to a 10% bonus under the investment tax credit (ITC). Projects can receive the bonus if they are less than 1 MWAC, began construction before Jan. 29, 2023, or meet prevailing wage and apprenticeship requirements.

In summary: projects smaller than 1 MW that use domestic products can get the bonus credit OR large-scale projects that pay a prevailing wage and meet apprenticeship metrics and use domestic products can receive the bonus credit.

The domestic content bonus applies to projects built using required amounts of domestic-produced steel, iron and manufactured products. A product is considered to be “Made-in-USA” under this rule if 40% of the cost to manufacture it (when used on projects beginning construction before 2025) was completed within the United States. That rule increases to 55% for projects beginning construction after 2026. The cost of a U.S. product is defined as “direct materials and direct labor costs that are paid or incurred … to produce the U.S. product.” The manufacturer of a U.S. product is considered to be the one performing the actual manufacturing process, not a distributor or secondary sales division.

To receive the bonus, all steel and iron manufacturing processes used in significant structural components must take place in the United States. This requirement is not applicable for steel or iron subcomponents (such as nuts, bolts, screws and clamps). Racking, piles, ground screws and rebar used in foundations are considered to be “steel and iron products.”

Solar trackers, solar panels and inverters are classified under the “manufactured products” designation. American-assembled solar panels must have the following domestically made materials to receive the full credit amount: solar cells, frame and back rail, glass, encapsulant, backsheet, junction box, edge seals, pottants, adhesives, bus ribbons and bypass diodes. Solar Energy Industries Association (SEIA) reps suggested partial credit amounts could be granted, but a deeper review of the the IRS materials will need to be completed.

Also relevant to solar and storage projects, domestic battery packs (including cells, packaging, thermal management system and BMS), battery enclosures and inverters can receive this adder.

While the industry determines product standards, Treasury said it is providing a safe harbor for certain types of projects. The department is welcoming input on how products are classified and is open to considering alternative approaches to classification, including a tax-specific, technology-neutral, principles-based approach.

“This highly anticipated guidance from the Treasury Dept. is an important step forward and will spark a flood of investment in American-made clean energy equipment and components. The U.S. solar and storage industry strongly supports onshoring a domestic clean energy supply chain, and today’s guidance will supplement the manufacturing renaissance that began when the historic IRA passed last summer,” said Abigail Ross Hopper, president and CEO of SEIA.

Solar Energy Manufacturing for America (SEMA) Coalition issued the following statement from Executive Director Mike Carr:

Though it is great to see the bonus designed to unlock future U.S. cell production, a number of core components of the solar value chain were excluded. The simple fact is today’s announcement will likely result in the scaling back of planned investments in the critical areas of solar wafer, ingot, and polysilicon production.

Read as a whole, the Inflation Reduction Act provided sufficient discretion to Treasury to recognize existing U.S. solar manufacturing investments and phase in other core components of the supply chain. Unfortunately, this reading of the Inflation Reduction Act misses the forest for the trees and, most importantly, misses Congress’ intent in the Inflation Reduction Act to reshore the entire solar supply chain.

Which module manufacturers qualify for this??

Are there any inverters that qualify for this and have an approval letter? I called Fronius and although they have an office in IN, all is made in Austria.

According to our data in our global inverter list, Seems that only Alencon, CE+T, Chilicon, CyboEnergy, Enphase, EPC Power, MidNight Solar, OutBack, Oztek, Sol-Ark, TMEIC, and Yaskawa Solectria could maybe qualify for this. They have U.S. manufacturing locations.

The new Tesla powerwall 3 is a battery with its own inverter built in

It’s only for commercial. The domestic tax credit is section 25D, which have no adders available. ITC is section 48. They’re entirely different credits.

great article. it’s interesting they PV racking as steel and iron and PV tracker as manufactured products.

In normal tracking type of ground mounting structure, it would be ambiguous to distinguish which exact parts are PV tracker and which parts are racking. Would torque tube to be categorized as racking or component of tracker? It seems the player would ask for more precise guideline. it would be good article subject for Solar Power world to raise a question.

And does that addtional 10% bonus trickle down to the end-user consumer also adding 10% to the Income Tax Credit on their next filing?

Trying to figure out the same thing. I’ve had installers tell me yes and others tell me it’s only for commercial installations.