The solar panel subcomponent manufacturing market is heating up in the United States. In addition to more backsheets, EVA sheets and glass being made in America, solar panel makers will soon be able to use Made-in-USA junction boxes in their final product, thanks to Amphenol Industrial Operations.

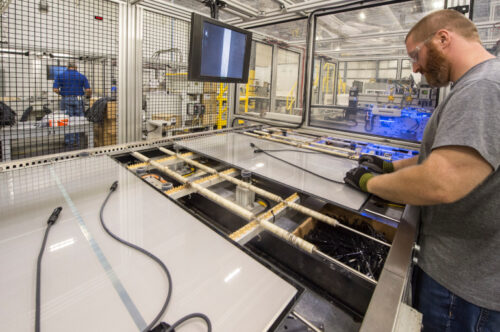

NREL archive photo of junction box and wire assembly on First Solar Series 4 modules in the company’s Ohio manufacturing plant.

Amphenol Industrial Operations (AIO), a business unit of Amphenol Corporation, is a leader in interconnect systems for harsh environment applications. The business unit intends to open a 58,000-sq.-ft factory in Mesa, Arizona, to make junction boxes and their associated connectors for both thin-film and silicon solar panel designs. The facility, which should open before the end of the year, will create 50 specialized jobs in the solar manufacturing market.

Mark Farrelly, business development director of environmental solutions for AIO, told Solar Power World that although the investment in the junction box factory seems small compared to the billions being spent on new solar cell and panel facilities, domestic junction boxes have become an important part of manufacturing incentive discussions.

“We had 22 meetings with module manufacturers at RE+, nearly all of which expressed greater than 50% interest in [AIO making junction boxes in the United States],” he said. “They want to know how fast, kind of chomping at the bit, asking can we deliver this year.”

For solar panels to qualify for “domestic content” bonus credits in the IRA, 40% of their manufactured components must be American-made. Junction boxes are one component that factors into the domestic content calculation.

AIO is a global business playing in many industries, mostly focusing its solar business in factories in Shenzhen, China; Nogales, Mexico; and Pecs, Hungary. But AIO is also a business unit of a U.S-based parent company, so setting up an operation in America was a natural fit.

“In the last year and a half, even prior to the IRA, there’s been a global movement to diversify outside of China. AIO already had a factory operationally in Hungary that had nothing to do with solar. One of our customers in Germany asked if we could make junction boxes in Europe, so we quickly set up and did some assembly,” Farrelly said. “Then when the IRA was released, and the need was more urgent in the United States, it was [an obvious path for us].”

This new AIO factory in Mesa joins a few other Amphenol buildings in the area focused on military and aerospace operations. Although this is a new building with new equipment, Farrelly said the startup has been quick due to the company’s existing presence in the area. A small amount of product should begin rolling off lines by the end of 2023.

AIO will focus on two core junction box designs — a rounded unit for thin-film panels and a three-box design for silicon panels. The silicon panel design is fairly generic and easily adoptable across most brands — the three-box setup has become most common on half-cell and other advanced panel designs. But AIO can adapt its lines quickly for custom box designs as needed.

The junction boxes will come with AIO’s H4 connectors. Farrelly said that he understands many in the industry have defaulted to Staubli MC4 connectors, but the H4 connector was once the dominant brand in North America.

“We’re a much larger connector company, just not as big within solar,” he said. “I’m hopeful that the junction box business will naturally move more module manufacturers back to the H4 family of connectors.”

Junction box production is measured in pieces rather than megawatts. Each line can make 100,000 pieces a month, and the Mesa facility will have the space for a dozen lines. (Using a 400-W module as default, Solar Power World estimates this to be about 4.8 GW of annual production.)

“You give me six months lead time, and I’ll build you as many lines as you want,” Farrelly said. “We have the space, we have the capital to supply as much equipment as needed to produce as much as they want.”

Tell Us What You Think!