While some panel manufacturers are continuing to perfect the generating capabilities of today’s solar cells, other companies have already shifted to tomorrow’s technologies. PERC designs will still be dominant, but more panels are beginning to use larger wafers to improve power output without much R&D effort.

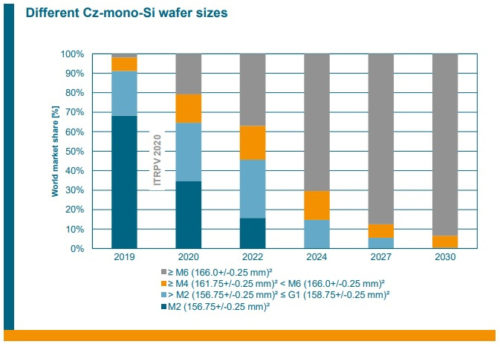

Most solar panels released in the last two years used M2 (156.75-mm) wafers. But research group ITRPV predicts that the M2 wafer will disappear within five years. M6 (166-mm) and larger wafer formats will make up 70% of the multicrystalline market and 90% of the monocrystalline market by 2030.

The bigger the wafer, the more power it can generate because of its larger surface area. By removing that unnecessary whitespace between smaller cells, fully assembled modules using larger wafers are more powerful in the same module footprint.

LONGi Solar, a Chinese solar cell and module manufacturer, began using M6 wafers in its bifacial modules released in 2019. LONGi has since transitioned all its manufacturing lines to the larger wafer and is already leading the switch to even larger M10 (182-mm) wafers. As one of the main cell suppliers to the industry, other panel assemblers are dependent on whatever LONGi makes.

Trina Solar, which is supplied by Chinese cell manufacturer Tianjin Zhonghuan Semiconductor (TZS), took a giant leap to G12 (210-mm) wafers and began releasing models under the Vertex brand name in 2020. While M6 wafers can mostly continue to be used in traditionally sized 60- and 72-cell panel frames, even larger M10 and G12 wafers lend to larger-format modules most suitable for utility-scale solar projects.

Those two camps — LONGi with M10 and TZS with G12 wafers — will likely split the industry into “wafer alliances,” predicted by solar and storage technical advisory Clean Energy Associates (CEA) in its 2020-released “PV Supplier Market Intelligence Program Report.” Depending which direction each manufacturer goes, production equipment will need to be adapted to the differing sizes.

“We expect to see multiple wafer sizes on the market for some time, as suppliers seek new ways to reduce cost, increase value for buyers and differentiate their products,” said Paul Wormser, VP of technology for CEA, in a press release. “This unprecedented innovation simultaneously brings uncertainty, as suppliers adopt the wafer platform, the interconnection platform and optimize the overall module.”

ITRPV says it is possible for large-format modules with M10 and G12 wafers to begin mass production in 2024 for utility-scale deployment, but rooftop projects will continue to use traditionally sized modules (likely with M6 wafers) until those wafer alliances are settled.

There are a few outliers. REC, which makes its own solar cells using heterojunction technology and focuses primarily on the rooftop segment, has transitioned out of M2 wafers into M4 (161.75-mm) but is still waiting to go larger.

“We have not yet manufactured a product with an M6 wafer, but we can and will do this if that is what our customers demand,” said Cary Hayes, president of the Americas at REC Group. “In the rooftop segment, particularly for residential installations, the benefits [of large-format modules] are less clear. If the benefits of installing larger modules on residential rooftops were as clear as they are in the utility segment, we probably would have already seen a shift to 72-cell modules in this market. We haven’t, which tells you that a larger-sized module is not the holy grail for residential installers.”

Tell Us What You Think!