If you follow Solar Power World’s U.S. solar manufacturing news, you know the domestic manufacturing market has never looked stronger. And while that is true and many companies are looking to invest in new facilities in the United States, years-long planning and construction processes are suddenly being rethought, specifically in the panel manufacturing space. Most companies are still waiting to see final domestic-content ITC bonus rules from the Dept. of Treasury to determine what size factory is worthwhile. New U.S. module manufacturers are also questioning their competitiveness in a market flooded with considerably cheaper imported solar panels.

Still, companies exhibiting at Intersolar North America last week wanted to broadcast their support of the U.S. market. I asked every panel manufacturer that said it was involved in the U.S. market exactly what it was planning. Some companies were very open about their statuses, and others gave hardly any information. I have everything here for you to make your own conclusions.

Meyer Burger didn’t need to be loud at Intersolar because its actions in Europe told the story. The company announced it was suspending its operations in Europe, including one of Germany’s longest-running solar panel factories, due to a deteriorating European market. Instead, Meyer Burger will put all its focus into its solar panel plant in Arizona, which just began receiving equipment. The 2-GW factory will receive cells from Germany until the company’s cell factory in Colorado gets going.

No news is good news for Maxeon. The company is still planning to open a 3.5-GW solar cell and panel manufacturing site in New Mexico sometime next year. Maxeon is awaiting news on a potential loan from the Dept. of Energy, which company execs said they hope to hear about in the next few months.

SEG Solar is ramping its 2-GW solar panel factory in Houston, Texas. The company said it will begin testing modules off the line in June and hopes to begin commercial production in July 2024. SEG is getting its cells from Indonesia, and it would eventually like to bring that manufacturing to the United States. A previously announced junction box manufacturing partnership would likely fit on a portion of SEG’s solar panel factory floor.

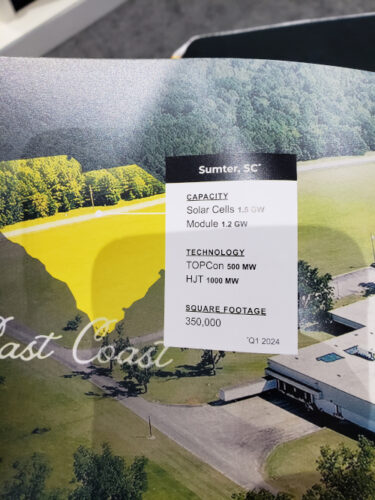

Hounen Solar is finishing up a 1-GW panel factory in South Carolina. No other major details were provided, except that C&D Clean Energy is taking a portion of the capacity and white-labeling modules eventually.

Chinese company Toenergy claims that is starting a 500-MW solar panel factory in Sacramento. The company currently operates in Malaysia.

Chinese company Runergy confirmed it was supporting a 2-GW solar panel factory in Alabama. The factory should begin production in April, Runergy said.

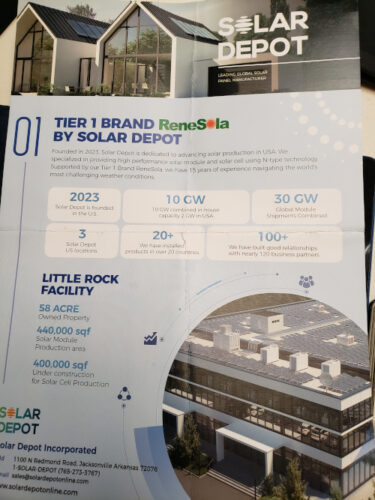

New company Solar Depot has a 440,000-ft2 building in Arkansas it says will begin making panels for the utility-scale market in June this year. The company is licensing ReneSola tech. No further information on megawatt capacity of the factory.

Indian brand Rayzon confirmed it is partnering with the previously announced Adion Solar to start panel manufacturing in the United States. The company has land outside Atlanta, Georgia, to build the factory but is waiting for final Treasury rules before pulling the trigger.

Turkish company Energate said it is building a 500-MW solar panel factory in West Valley, Utah, and expects production to begin in three months. Then the company will set its sights on an East Coast manufacturing hub in 2025. Energate panels are branded as AE Solar in Europe.

New company SolarLink said it’s starting a 2-GW panel factory in North Las Vegas, Nevada. The brand new building will likely host two assembly lines and 150 employees. SolarLink is fronted by the former COO of JA Solar.

Chinese company Phono Solar (with SUMEC Group) claims it will start a 1-GW panel factory somewhere in South Carolina by Q2 this year. The company also has manufacturing locations in Cambodia, Laos and Vietnam.

Solarever USA has operated a panel factory in Mexico for the last few years, but claimed at Intersolar it was assembling its 550-W, silver-frame module for the utility-scale market in the United States. Company reps could not say where the panels were being assembling or how big the factory was, but said Solarever owns the factory and is not an OEM.

Indian company Waaree announced late last year it was starting a 3-GW panel factory in Texas. Everything is still on track.

Solar4America’s South Carolina factory is almost complete. It is awaiting cell manufacturing equipment. The company’s California panel factory is producing as announced.

LONGi Solar was a featured sponsor of the Solar Games, and its solar panels were used by the teams competing for the best installation company. LONGi confirmed its first panels have come off the line of its 5-GW factory in Ohio, and the site should reach 3 GW of production capacity before the end of the year.

Also exhibiting at Intersolar was Canadian Solar, which has also begun early panel production at its 5-GW factory in Texas.

Kelly

Thanks very much for your article . Build in America has become a shady declaration from many and creates I fair competition for whom really invest in this country . I would strongly recommend you do the same analysis for solar inverter and solar / charger inverter . Not only the market has no way to weed the fake one but there is a bias UL certification system in place allowing the system to be UL certified in Asia cheaper and with many short cuts as opposed to our inland rigid and expensive certification process .

Hi Kelley, thank you for the article. It is very hard for any company to follow up all the BS created by solar manufacturers. I actually fly to the plant site to visit and many times find nothing. You do a great professional job and have been a dedicated solar advocate. Keep it up you are still young.

Kelly, thanks for staying on top of this. This is important stuff, keep it up

The success of American make solar panels will depend on its cost and financial support from government. The P2P and P2U sale by prosumers is not much appreciated by utilities as the the unit cost refund is very nominal . Further the supply from utilities is very reliable as such individual consumers may not feel the necessity.

Hi Kelly! We spoke at Intersolar. This is a great article. I appreciate all the information.

They should label “Assembled in USA” because all key components are made in China and most players are Chinese or partnered with Chinese companies

Please tell us about First Solar and their plants in Ohio. Also, are there any companies manufacturing solar peripherals in the US as well? Like Enphase?

Great article!

Check out all our charts of U.S. manufacturers (links to stories within):

https://www.solarpowerworldonline.com/u-s-solar-panel-manufacturers/

https://www.solarpowerworldonline.com/u-s-solar-mounting-manufacturers/

https://www.solarpowerworldonline.com/u-s-solar-inverter-manufacturers/

What about Longi? We sponsored the Solar Games to make sure everyone knew about our joint venture 3GW (5GW in 2025) factory with Invenergy in Ohio!

You’re right! Since technically the plant is already operating, I didn’t include it in my list here. Congrats on the first panels off the line!

Where is QCells

Qcells didn’t exhibit at Intersolar! But the company’s factory in Georgia is still going on as scheduled.