The Dept. of Commerce has pushed the deadline to issue a final decision on an antidumping/countervailing duties (AD/CVD) circumvention investigation to August 17, 2023. The final decision was originally supposed to come next week.

Jose Rivera, International Trade Compliance Analyst, AD/CVD Operations, Office VII, stated in a memo that extensive case and rebuttal briefs were submitted by approximately 20 interested parties, and Commerce needs more time to fully consider everyone’s statements.

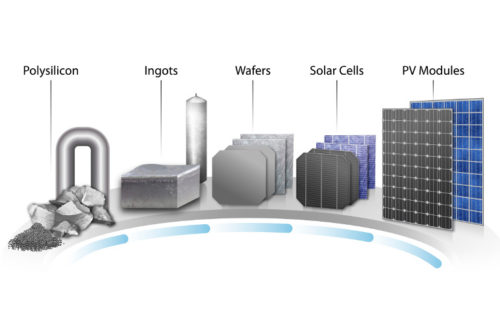

Commerce preliminary decided in December 2022 that Chinese solar cell and panel producers were working in Cambodia, Malaysia, Thailand and Vietnam as a way to avoid paying duties on Chinese-made solar goods that have been in place since 2012. Commerce initially suggested AD/CVD to crystalline silicon cells using Chinese wafers and final panels made with Chinese wafers that also use three of the following Chinese-made materials: silver paste, aluminum frames, glass, backsheets, ethylene vinyl acetate sheets and junction boxes. Wafers produced outside of China with Chinese polysilicon are not considered to be wafers produced in China.

The tariffs were suggested for all exports out of the four Southeast Asian countries, except from four individual companies that were investigated and found to not be circumventing the tariffs: New East Solar (Cambodia), Hanwha Qcells (Malaysia), JinkoSolar (Malaysia) and Boviet Solar (Vietnam).

Any extended tariffs would not go into effect until after June 6, 2024, on account of President Joe Biden’s 2022 executive action that paused additional tariffs for two years. Congress is attempting to overturn the executive decision through a Congressional Review Act (CRA), but all information coming from Capitol Hill suggests failure of the Act.

Since the preliminary decision in December, solar panel manufacturers have been asking Commerce to clarify the department’s new “wafer-forward” ruling. The AD/CVD parameters of 2012 placed tariffs on the silicon cell and forward to the module. The country point of origin was determined to be where the p-n junction is activated, which happens at solar cell development. The 2022 preliminary decision shifted the tariff rules back one step to the silicon wafer.

Solar Power World previously reported on the uneven solar panel manufacturer support of the extended tariffs. Auxin Solar is the only silicon solar panel manufacturer on-record in favor of the tariffs. Auxin said in its original petition to the DOC that Chinese solar producers working in Southeast Asia were unfairly pricing their products to undercut American manufacturers. Auxin said itself and other American manufacturers were struggling to compete with cheap imports. The AD/CVD extension’s only other supporter is CdTe thin-film manufacturer First Solar, whose solar panel products are not included in the tariff scope. Many American panel manufacturers, including Silfab Solar, stated in documents to the DOC that Auxin did not represent the “interests of the domestic solar industry as a whole.”

Until silicon cell manufacturing is established in the United States (something that only three companies have suggested they will start by the end of 2024), all American solar panel assemblers will have to import solar cells that would likely come with any Commerce-decided tariffs.

Tariff rates are not included in circumvention investigations, but Clean Energy Associates previously released information on how they may be set:

“For manufacturers that also have operations in China, the duty rate on their cells and modules made in the named countries (Cambodia, Malaysia, Thailand and Vietnam) will be the same that they pay for their product exported from China. For companies that don’t make cells in China but make cells in the named countries using Chinese wafers, then duty rates are based on the rates of the Chinese company that makes the wafer — if that company has a duty rate. If these cells use Chinese wafers from a company that does not have a rate, then these cells and modules will get the “China-wide” anti-dumping rate of 238.95% and the “all-others” countervailing-duty rate of 15.24%.”

Tell Us What You Think!